CITY OF CORTLAND

Real Property Tax

Foreclosure Auction

Properties

of All Types Throughout

The City of Cortland & Cortland County

Wednesday, July 24, 2019 @ 6:00PM

Auction

To Be Held @ City Of Cortland, City Hall Court Room, 25 Court Street, Cortland,

NY 13045.

TERMS & CONDITIONS OF AUCTION

We welcome

you to the City of Cortland Real Property Tax Foreclosure Auction. This auction

presents to you a great opportunity to purchase properties of all types, being

sold at one location. The descriptions and information in this catalog is what

has been provided to us. Use this catalog as a guide only. We make no

Warranties or Guarantees to the information provided, as you are encouraged to

do your own due diligence in researching the properties. Please read fully the

Terms & Conditions of Sale in this catalog. Announcements made day of Auction

take precedence over printed material. Thank You all for attending and we wish

you all good luck in your bidding! A great opportunity!! Real Estate is the

Best Investment!!

Auction To Be Held @ City Of Cortland, City Hall Court Room, 25 Court Street,

Cortland, NY 13045.

General

1.

All properties offered at this auction have been foreclosed due to Real

Property Tax Law. All properties are sold “AS IS-WHERE IS-HOW IS”. Bidder

shall be solely responsible for determining all conditions of the property prior

to bidding. The City makes no representation as to the quality of title, lot

size, shape or location, or conditions or existence of any or all improvements

on any parcel or to the condition of the property(ies), this also applies to the

concern of environmental problems. The City make no promises or statements of

fact about any parcel that is being offered for sale. No employee or agent of

the County has any authority to make any promises or representations of any

nature concerning any of these parcels. It is the responsibility of each bidder

to investigate any and all aspects of the status of each parcel that he or she

may desire to purchase PRIOR TO BIDDING ON THE PARCEL.

2.

You are strongly encouraged to go to the property(ies) you are interested

in and examine them in person from the sidewalk or street. You are, however,

prohibited from trespassing on the property(ies) or entering the building(s), if

applicable. This restriction also applies to the highest bidder on the property

until the Quit Claim Deed transferring ownership from the City to the new owner

is recorded in the County Clerk’s Office.

3.

Properties will be conveyed to the highest qualified bidder. The City of

Cortland reserves the right to reject any and all bids of any kind. The

delinquent taxpayer nor anyone acting on their behalf shall be entitled to bid

or purchase the property. The individuals who have previously defaulted on a

bid, or who are currently delinquent on any other parcel in the City shall not

be permitted to bid on any properties offered at this auction.

4.

The Former Owner of the property, or his agent(s) shall not be deemed the

successful bidder on a County / City property or purchase their former property

at the public auction, UNLESS THE PREVIOUS OWNER PAYS THE AUCTION BID

PRICE, AUCTIONEERS FEE, ALL RECORDING & ADMINISTRATIVE FEES AND ALL BACK,

CURRENT & DELINQUENT TAXES AND PENALTIES IN CERTIFIED OR GUARANTEED FUNDS.

PREVIOUS OWNERS WILL ONLY BE ALLOWED TO BID WITH PRIOR COUNTY / CITY TREASURER

APPROVAL, 3 DAYS PRIOR TO AUCTION DAY & MUST MEET ALL REQUIREMENTS STATED

ABOVE. IF THE FORMER OWNER OR HIS AGENT RE-ACQUIRES THE PROPERTY, ALL LIENS

EXISTING PRIOR TO THE FORECLOSURE SHALL BE REINSTATED AND THE FORMER OWNER MUST

SIGN THE DEED TO RE-INSTATE THE LIENS.

5.

The City of Cortland reserves the right to withdraw from sale any

properties which are listed and or at their option, to group one or more parcels

together into one sale. All items may be sold in random order.

6.

Auction & Tax information is available at the City of Cortland Department

of Administration & Finance, 25 Court Street, Cortland, NY. Tax maps are

available for viewing at the Cortland County Real Property Tax Office at 60

Central Avenue, Cortland, NY. Tax maps are only representations and may depict

a proposed development or road. The City do not guarantee that a development

and/or road actually exists, nor does it guarantee the eventual development of

such. Tax maps do not represent exact dimensions and are not intended to be

used in place of a survey map. Tax maps may not accurately depict the exact

location of a property. Bidders are also encouraged to obtain the zoning

regulations from the municipality where the property is located. Town zoning

and building code information can be obtained at the town, city or village where

the property is located. It is the responsibility of the bidder to research any

existing violations or restrictions on the property. Any promotional tools such

as photographs, tax maps, signs, written or verbal descriptions, etc. are for

informational purposes and guide only.

7.

All deeds issued shall be by Quit Claim Deed only. The City will not

furnish an abstract of title or title insurance.

8.

The Auctioneer and the Seller shall remain forever immune from any and

all liability concerning any personal injury, environmental hazards or property

damage occurring before, during or after the auction, no matter what the cause.

Additionally, the Auctioneer and Seller shall remain forever immune from the

consequences of purchase of any and all properties at this auction.

9.

All decisions regarding bidding disputes shall remain completely within

the Auctioneer’s discretion. The Auctioneer retains the right to reject any bid

that is not within current bidding increments or that is not an appropriate

advancement over the preceding bid.

Financial

-

All prospective bidders

must register the day of the auction in person. Registration will begin at

5:00 PM the day of the Auction. Individuals must show a valid drivers

license for issuance of a buyer number. Each purchaser will be required to

sign a legally binding Property Bid Acknowledgement Form for each purchase

which commits the purchaser to compliance with all Terms and Conditions as

stated herein. No mailed or faxes bids will be accepted.

-

All bid deposits must be

made with cash or good check, immediately following the auction, and a

receipt will be issued. Persons are required to have multiple checks for

payment purposes, If paying by personal check, please keep this in

mind. We recommend potential buyers, paying by check, to bring with them a

˝ dozen checks, for each property, in order to pay all moneys due day of

Auction, in separate checks.

Bid Deposit Requirement

A.

If the successful bid is under $1,000.00 the FULL AMOUNT of the bid must

be paid by the end of the auction to City of Cortland, depending on the property

purchased.

B.

If the successful bid is over $1000.00, a deposit of 10% of the bid price

or $1,000.00, whichever is greater is due at the end of the auction.

C.

It is the successful bidder’s responsibility to pay the auctioneer 7 ˝ %

above the bid price on the day of the Auction.

Multiple Checks Will Be

Needed To Pay For Each Property.

D.

For City

Of Cortland Properties Purchased:

In addition to the bid deposit & auctioneers fee, the successful bidder will be

responsible for an administrative fee of $275.00 (per parcel), recording fee for

the deed(s), transfer tax(es) connected with the property(ies) and a County

Clerk Fee (per parcel). The Purchaser will be responsible for one half of the

2019 City Tax Bill; and these taxes will be due at closing. Amounts will be

available prior to the auction. The Purchaser will also be responsible for all

of the 2019-2020 School Tax Bill, which will be available on or about August 1,

2019. In the Event the School Tax Bill is not available on the day of the

Auction, it is the responsibility of the Successful Bidder to contact Cortland

City Schools for a copy of the 2019/2020 School Tax Bill. Successful Bidders

will be responsible for all future taxes following closing. The administrative

fee will be collected at the end of the auction (on City Properties) with bid

deposit & auctioneers fee. The Taxes stated above, recording fee for deed(s),

transfer tax(es) and County Clerk Fee will be collected at the time balance is

paid to the City Treasurer.

E.

DEPOSITS AND PAYMENTS must be cash or good personal checks. Checks are

to be made payable to City of Cortland (for City Properties) as well as a check

made payable to Mel Manasse & Son, Auctioneers regarding the auctioneer fee (For

All Properties). Administrative fees (for City of Cortland Properties) Is Due

The Day Of Auction.

F.

Full payment of bid is required within thirty (30) days following the

auction. At this time, you must present to the City the receipt received day of

auction and the balance must be satisfied in cash or certified funds, and made

payable to City of Cortland. If the successful bidder fails to pay the balance

of such purchase price within the required thirty (30) day period, the bid

deposit, auctioneers fee, administrative fee and any additional fee(s) may be

forfeited and retained by the City of Cortland as well as the auctioneer, at the

option of the City Treasurer.

G.

Evictions, if necessary, are solely the responsibility of the successful

bidder after closing and recording of the deed.

H.

The purchaser may not assign his / her right to complete the sale. ALL

DEEDS SHALL BE EXECUTED SOLELY IN THE NAME OF THE BIDDER AND THEIR SPOUSE, IF

DESIRED.

I.

No personal property is included in the sale of any of the parcels owned

by the City of Cortland. The disposition of any personal property on any parcel

sold shall be the sole responsibility of the successful bidder following

closing.

J.

Default by purchaser or failure to meet these rules, terms and conditions

will result in forfeiture of the required deposits and may result in rejection

of any future offers of City owned property.

Deed Description

The City of Cortland will

issue a Quit Claim Deed consisting of the popular description listed in the

auction notice. This information has been obtained from the Real Property Tax

Service office inventory file, and is for ease of identifying only. The Deed

will be issued within 30 days after the auction.

* All successful bidders (of

City Of Cortland Properties) will be responsible for one half of the 2019 City

Tax Bill; and these taxes will be due at closing. Amounts will be available

prior to the auction. The Purchaser will also be responsible for all of the

2019-2020 School Tax Bill, which will be available August 1, 2019. In the Event

the School Tax Bill is not available on the day of the Auction, it is the

responsibility of the Successful Bidder to contact Cortland City Schools for a

copy of the 2019/20 School Tax Bill. Successful Bidders will be responsible

for all future taxes following closing.

Possession

The purchaser may not take

possession of the premises until the deed has been recorded. Possession of the

parcel(s) may be subject to the occupancy of previous owner(s) and / or

tenant(s). It shall be the responsibility of the purchaser to obtain possession

and/or evictions of former occupants. The City of Cortland is not responsible

at any time for obtaining access to the buildings located on the premises.

Deed Restrictions

The City of Cortland reserves

the right to require that each deed issued will contain a restriction in

reference to the prior owner. This restriction that requires an additional

payment equal to the accumulated taxes, penalties, and interest due as of the

tax foreclosure. It will apply only if the property is sold to the former owner

or his/her spouse or children during the seven years following the purchase.

Common Questions & Answers:

How much are the back taxes owed on the property(ies)?

City of

Cortland are selling these properties foreclosed for the purpose of unpaid taxes

to place the parcels back on the tax rolls, after being sold to responsible

purchaser(s). Therefore, no back taxes are owed in purchasing the properties.

The only taxes due on the properties are as follows: For City of Cortland

Properties: The Purchaser will be responsible for one half of the 2019 City

Tax Bill; and these taxes will be due at closing. Amounts will be available

prior to the auction. The Purchaser will also be responsible for all of the

2019-2020 School Tax Bill, which will be available on or about August 1, 2019.

In the Event the School Tax Bill is not available on the day of the Auction, it

is the responsibility of the Successful Bidder to contact Cortland City Schools

for a copy of the 2019/2020 School Tax Bill. Successful Bidders will be

responsible for all future taxes following closing.

How can I see the inside of the property(ies) if there is a building on it?

- The City

of Cortland have certain properties which have a scheduled showing date & time.

All other properties, if not listed on the showings list, will NOT have a

showing on the property and you are to view from the road, at your own risk.

You are, however, prohibited from trespassing on any of the property(ies) or

entering the building(s), except during schedule showing date & time.

What is the starting bid on the properties?

- The

starting bid on the properties is determined by the public. The assessment does

not determine the starting bid and is provided for tax purposes only. Bidders

or Purchasers with questions regarding assessed values or assessment practices

are advised to contact the Assessors Office of the City in which the property is

located.

Can I register prior to the Auction?

- No,

registration will begin at 5:30PM the Morning of the Auction. You will not be

allowed to register for the Auction if you owe any City taxes, unless you have

received prior approval from the City of Cortland as stated in #4 General of The

Terms & Conditions.

How do I know I am getting a good title to the property?

- You are

encouraged to research the property in depth and do your own due diligence. The

City will issue you a Quit Claim Deed.

Do

I have to be there to bid on the property?

- Yes, you

must be present the day of the Auction to bid/purchase the property(ies). All

deposits are due the day of the auction, as stated above, and you will be

required to sign a Bid Acknowledgement Form for each purchase.

All

Properties Sold “AS IS” –

Properties Must Be Researched PRIOR To Bidding

Brochure Is To

Be Used Only As A Guide, And Is Subject To Change

Updated

Material Will Be Available @

www.manasseauctions.com

Statements

Made Day of Sale Take Precedence Over Printed Materials

Showings Time & Date:

Monday, July 22, 2019 @ 5:30PM-7PM

Serial #72 - 77 Lincoln Ave

Serial #115 - 10 William Street

Serial #161 - 138 Elm Street

City of Cortland

|

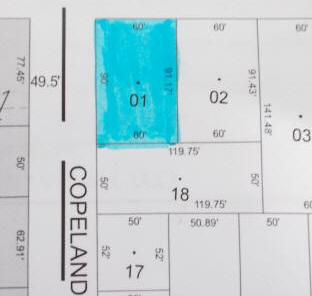

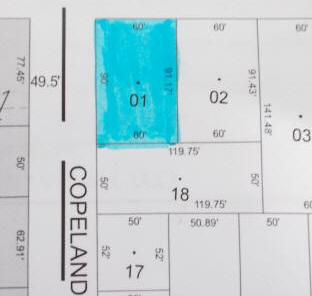

Serial # 10

City of Cortland

Address:

43 Evergreen Street

Lot Size:

60FF x 90FF – Corner Lot

Tax Map #:

86.24-03-01.000

Assessment:

$97,000

Description:

280 – Res. Multiple, Yellow & Grey Wood Sided, Corner Lot. Single Family

w/ Apt. Over Large Garage. Occupied.

Directions: Rt. 281 to Evergreen St. Corner of Evergreen

& Copeland Street.

|

|

|

|

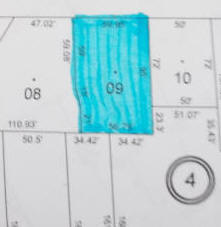

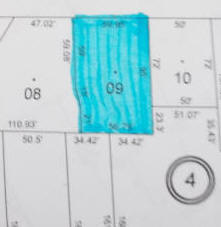

Serial # 72

City of Cortland

Address:

77 Lincoln Ave

Lot Size:

59.95FF x 95

Tax Map #:

86.49-04-09.000

Assessment:

$87,300

Description:

210 – 1 Family Res., Grey Wood Sided, 2-Story. Single Family Home,

Vacant.

Directions: Off Homer Ave Parallel w/ Groton Ave.

(Rt.#222)

Open House: Mon. 7/22 - 5:30-7:00PM

|

|

|

|

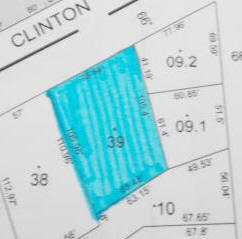

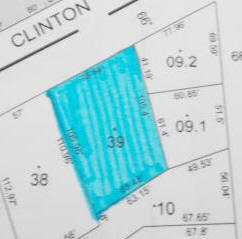

Serial # 81

City of Cortland

Address:

97 Clinton Ave

Lot Size:

78.84FF x 105.96

Tax Map #:

86.51-02-39.000

Assessment:

$57,200

Description:

210 – 1 Family Res., White 2-Story Single Family Home w/ Large 2-Car

Garage in Rear. Occupied.

Directions: Off I-81 to Clinton Ave

|

|

|

|

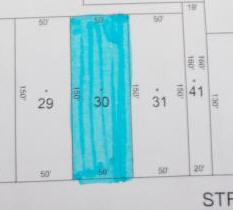

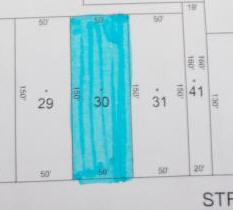

Serial # 115

City of Cortland

Address:

10 William Street

Lot Size:

50FF x 150

Tax Map #:

86.66-02-30.000

Assessment:

$77,200

Description:

210 – 1 Family Res., White Stucco, Single Family Home. Vacant.

Directions: Off South Main Street to William Street.

Open House:

Mon. 7/22 - 5:30-7:00PM

|

|

|

|

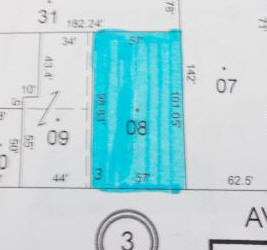

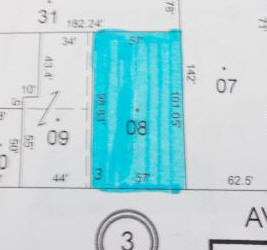

Serial # 147

City of Cortland

Address:

44 South Ave

Lot Size:

57FF x 101.05

Tax Map #:

86.81-03-08.000

Assessment:

$64,800

Description:

220 – 2 Family Res., Tan & Green Sided 2-Story Home. Single Family?

Occupied.

Directions: Tompkins St. to Owego St. to South Ave.

|

|

|

|

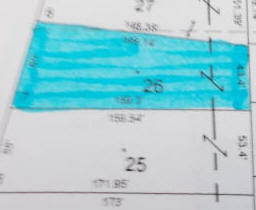

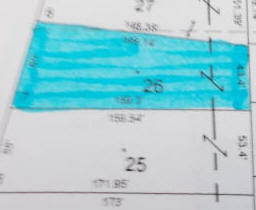

Serial # 149

City of Cortland

Address:

59 Owego Street

Lot Size:

60FF x 159.3

Tax Map #:

86.81-03-26.000

Assessment:

$75,100

Description:

210 – 1 Family Res., Grey 2-Story Single Family Home. 1-Car Garage in

Rear. Occupied.

Directions: Tompkins St. to Owego St.

|

|

|

|

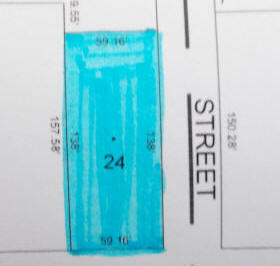

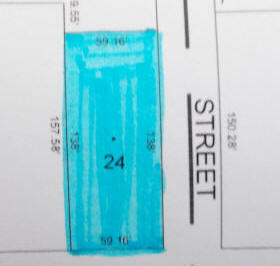

Serial # 161

City of Cortland

Address:

138 Elm Street

Lot Size:

59.16FF x 138FF -

Corner Lot.

Tax Map #:

87.45-01-24.000

Assessment:

$124,200

Description:

421 – Restaurant., Green Block Building, Single Story. Commercial

Building, Vacant.

Directions: Port Watson St. to Pomeroy St. to Elm St.

Open House: Mon. 7/22 - 5:30-7:00PM

|

|

|

Auctioneers & Licensed Real Estate Brokers

Licensed Real

Estate Brokers In NY & PA

Whitney Point, N.Y.

13862

607-692-4540 /

1-800-MANASSE

www.manasseauctions.com