Serial #11

City Of Cortland

Address:

287-288 Benham Hill

Lot Size:

15 x 7

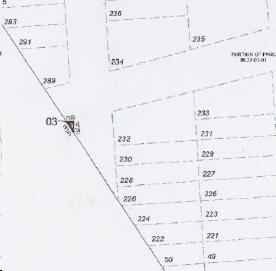

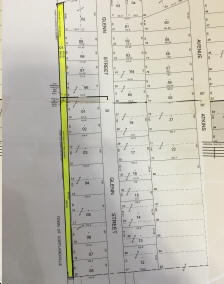

Tax Map #:

86.26-01-03.000

School District:

Cortland

City

Assessment:

$100

NO

PICTURE

Cortland County

AND

City Of Cortland

Real Property Tax

Foreclosure Auction

Properties of All Types Throughout

Cortland County & The City Of Cortland

Thursday

May 24, 2018

10:30 AM

Auction To Be Held @ The Cortland County Auditorium

60 Central Ave., Cortland, NY 13045

TERMS & CONDITIONS OF AUCTION

We welcome you to the County of Cortland & City of Cortland Real Property Tax

Foreclosure Auctions. This auction presents to you a great opportunity to

purchase properties of all types, being sold at one location. The descriptions

and information in this catalog is what has been provided to us. Use this

catalog as a guide only. We make no Warranties or Guarantees to the information

provided, as you are encouraged to do your own due diligence in researching the

properties. Please read fully the Terms & Conditions of Sale in this catalog.

Announcements made day of Auction take precedence over printed material. Thank

You all for attending and we wish you all good luck in your bidding! A great

opportunity!! Real Estate is the Best Investment!!

Auction Will Be Held @ The Cortland County Office Building Auditorium,

60 Central Avenue, Cortland, NY 13045.

General

1. All properties offered at this auction have been foreclosed due to Real Property Tax Law. All properties are sold AS IS-WHERE IS-HOW IS. Bidder shall be solely responsible for determining all conditions of the property prior to bidding. The County nor City makes no representation as to the quality of title, lot size, shape or location, or conditions or existence of any or all improvements on any parcel or to the condition of the property(ies), this also applies to the concern of environmental problems. The County nor City makes no promises or statements of fact about any parcel that is being offered for sale. No employee or agent of the County nor City has any authority to make any promises or representations of any nature concerning any of these parcels. It is the responsibility of each bidder to investigate any and all aspects of the status of each parcel that he or she may desire to purchase PRIOR TO BIDDING ON THE PARCEL.

2. You are strongly encouraged to go to the property(ies) you are interested in and examine them in person from the sidewalk or street. You are, however, prohibited from trespassing on the property(ies) or entering the building(s), if applicable. This restriction also applies to the highest bidder on the property until the Quit Claim Deed transferring ownership from the County / City to the new owner is recorded in the County Clerks Office.

3. Properties will be conveyed to the highest qualified bidder. The County of Cortland & City of Cortland reserves the right to reject any and all bids of any kind. The delinquent taxpayer nor anyone acting on their behalf shall be entitled to bid or purchase the property. The individuals who have previously defaulted on a bid, or who are currently delinquent on any other parcel in the County or City shall not be permitted to bid on any properties offered at this auction.

4. The Former Owner of the property, or his agent(s) shall not be deemed the successful bidder on a County or City property or purchase their former property at the public auction,

5. The County of Cortland & City of Cortland reserves the right to withdraw from sale any properties which are listed and or at their option, to group one or more parcels together into one sale. All items may be sold in random order.

6. Auction & Tax information is available at the Cortland County Treasurers Office, 60 Central Avenue, Cortland, NY And City of Cortland Department of Administration & Finance, 25 Court Street, Cortland, NY. Tax maps are available for viewing at the Cortland County Real Property Tax Office at 60 Central Avenue, Cortland, NY. Tax maps are only representations and may depict a proposed development or road. The County / City does not guarantee that a development and/or road actually exists, nor does it guarantee the eventual development of such. Tax maps do not represent exact dimensions and are not intended to be used in place of a survey map. Tax maps may not accurately depict the exact location of a property. Bidders are also encouraged to obtain the zoning regulations from the municipality where the property is located. Town zoning and building code information can be obtained at the town, city or village where the property is located. It is the responsibility of the bidder to research any existing violations or restrictions on the property. Any promotional tools such as photographs, tax maps, signs, written or verbal descriptions, etc. are for informational purposes and guide only.

7. All deeds issued shall be by Quit Claim Deed only. The County / City will not furnish an abstract of title or title insurance.

8. The Auctioneer and the Seller shall remain forever immune from any and all liability concerning any personal injury, environmental hazards or property damage occurring before, during or after the auction, no matter what the cause. Additionally, the Auctioneer and Seller shall remain forever immune from the consequences of purchase of any and all properties at this auction.

9. All decisions regarding bidding disputes shall remain completely within the Auctioneers discretion. The Auctioneer retains the right to reject any bid that is not within current bidding increments or that is not an appropriate advancement over the preceding bid.

Financial

Bid Deposit Requirement

A. If the successful bid is under $1,000.00 the FULL AMOUNT of the bid must be paid by the end of the auction to the County of Cortland / City of Cortland, depending on the property purchased.

B. If the successful bid is over $1000.00, a deposit of 10% of the bid price or $1,000.00, whichever is greater is due at the end of the auction.

C. It is the successful bidders responsibility to pay an administrative fee of $458 (per parcel), due at the end of the Auction For County of Cortland Properties

D. It is the successful bidders responsibility to pay an administrative fee of $275 (per parcel), due at the end of the Auction For City of Cortland Properties.

E. It is the successful bidders responsibility to pay the auctioneer 7 ½ % above the bid price on the day of the Auction, On All Properties Purchased.

Multiple Checks Will Be Needed To Pay For Each Property.

1. For Cortland County Properties Purchased: In addition to the bid deposit, administrative fee & auctioneers fee, the successful bidder will be responsible for a recording fee for the deed(s), transfer tax(es) connected with the property(ies) and a County Clerk Fee (per parcel). The purchaser will be responsible for the 2018 Town and County Tax Bill, Including Relevies, If Any, Payable In The Treasurers Office. The purchaser may also be responsible for the 2018/2019 Enlarged City School Tax Bill payable in the Treasurers Office. Successful Bidders will be responsible for all future taxes following closing. The bid deposit, auctioneers fee and administration fee will be collected at the end of the auction .The Enlarged City School taxes, stated above, recording fee for deed(s), transfer tax(es), and County Clerk Fee will be collected at the time balance is paid to the County Treasurer.

2. For City of Cortland Properties Purchased: In addition to the bid deposit, administrative fee & auctioneers fee, the successful bidder will be responsible for a recording fee for the deed(s), transfer tax(es) connected with the property(ies) and a County Clerk Fee (per parcel). The Purchaser will be responsible for 1/2 of the 2018 City/County Tax Bill; and these taxes will be due at closing. Amounts will be available prior to the auction. The Purchaser will also be responsible for all of the 2018-2019 School Tax Bill, which will be available on or about August 1, 2018. In the Event the School Tax Bill is not available on the day of the Auction, it is the responsibility of the Successful Bidder to contact Cortland City Schools for a copy of the 2018/19 School Tax Bill. Successful Bidders will be responsible for all future taxes following closing. The administrative fee will be collected at the end of the auction (on City Properties) with bid deposit & auctioneers fee. The Taxes stated above, recording fee for deed(s), transfer tax(es) and County Clerk Fee will be collected at the time balance is paid to the City Treasurer.

F. DEPOSITS AND PAYMENTS must be cash or good personal checks. Checks are to be made payable to Cortland County Treasurer For County Properties Or City of Cortland For City Properties, as well as a check made payable to Mel Manasse & Son, Auctioneers regarding the auctioneer fee (For All Properties).

G. Full payment of bid is required within thirty (30) days following the auction. At this time, you must present to the County / City, the receipt received day of auction and the balance must be satisfied in cash or certified funds, and made payable to Cortland County Treasurer For County Properties Or City of Cortland For City Properties. If the successful bidder fails to pay the balance of such purchase price within the required thirty (30) day period, the bid deposit, auctioneers fee, administrative fee and any additional fee(s) may be forfeited and retained by the County of Cortland as well as the auctioneer, at the option of the County Treasurer.

H. Evictions, if necessary, are solely the responsibility of the successful bidder after closing and recording of the deed.

I. The purchaser may not assign his / her right to complete the sale. ALL DEEDS SHALL BE EXECUTED SOLELY IN THE NAME OF THE BIDDER AND THEIR SPOUSE, IF DESIRED.

J. No personal property is included in the sale of any of the parcels owned by Cortland County / City of Cortland. The disposition of any personal property on any parcel sold shall be the sole responsibility of the successful bidder following closing.

K. Default by purchaser or failure to meet these rules, terms and conditions will result in forfeiture of the required deposits and may result in rejection of any future offers of County / City owned property.

Deed Description

The County of Cortland / City of Cortland will issue a Quit Claim Deed consisting of the popular description listed in the auction notice. This information has been obtained from the Real Property Tax Service office inventory file, and is for ease of identifying only. The Deed will be issued within 30 days after the auction.

Possession

The purchaser may not take possession of the premises until the deed has been recorded. Possession of the parcel(s) may be subject to the occupancy of previous owner(s) and / or tenant(s). It shall be the responsibility of the purchaser to obtain possession and/or evictions of former occupants. The County of Cortland / City of Cortland is not responsible at any time for obtaining access to the buildings located on the premises.

Deed Restrictions

The County of Cortland / City of Cortland reserves the right to require that each deed issued will contain a restriction in reference to the prior owner. This restriction that requires an additional payment equal to the accumulated taxes, penalties, and interest due as of the tax foreclosure. It will apply only if the property is sold to the former owner or his/her spouse or children during the seven years following the purchase.

Common Questions & Answers:

How much are the back taxes owed on the property(ies)?

- The County of Cortland / City of Cortland are selling these properties foreclosed for the purpose of unpaid taxes to place the parcels back on the tax rolls, after being sold to responsible purchaser(s). Therefore, no back taxes are owed in purchasing the properties. The only taxes due on the properties are as stated above in the term;

How can I see the inside of the property(ies) if there is a building on it?

- The County of Cortland / City of Cortland have certain properties which have a scheduled showing date & time. All other properties, if not listed on the showings list, will NOT have a showing on the property and you are to view from the road, at your own risk. You are, however, prohibited from trespassing on any of the property(ies) or entering the building(s), except during schedule showing date & time.

What is the starting bid on the properties?

- The starting bid on the properties is determined by the public. The assessment does not determine the starting bid and is provided for tax purposes only. Bidders or Purchasers with questions regarding assessed values or assessment practices are advised to contact the Assessors Office of the Town in which the property is located.

Can I register prior to the Auction?

- No, registration will begin at 9:00AM the Morning of the Auction. You will not be allowed to register for the Auction if you owe any County / City taxes.

How do I know I am getting a good title to the property?

- You are encouraged to research the property in depth and do your own due diligence. The County / City will issue you a Quit Claim Deed.

Do I have to be there to bid on the property?

- Yes, you must be present the day of the Auction to bid/purchase the property(ies). All deposits are due the day of the auction, as stated above, and you will be required to sign a Bid Acknowledgement Form for each purchase.

All Properties Sold AS IS

Properties Must Be Researched PRIOR To Bidding

Brochure Is To Be Used Only As A Guide, And Is Subject To Change

Updated Material Will Be Available @ www.manasseauctions.com

Statements Made Day of Sale Take Precedence Over Printed Material.

Showing Dates & Times

Sunday, May 20, 2018

1:30PM To 2:30PM Town of Freetown 2078 Carter Slocum Rd.

3:15PM To 4:15PM Town of Cuyler 5358 Lincklaen Rd. CANCELLED

4:30PM To 5:30PM Town of Virgil 2731 Route 215

Village of Marathon 56 Cortland St. (Rt. 11N)

Monday, May 21, 2018

5:00PM To 6:15PM City of Cortland 26 Washington St.

City of Cortland 81 Bartlett Ave.

City of Cortland 23 Fox Hollow Rd.

6:30PM To 7:30PM Town of Homer 161 Creech Rd.

Town of Cortlandville 4335 Miller St.

All Properties Sold AS IS

Properties Must Be Researched PRIOR To Bidding

Brochure Is To Be Used Only As A Guide, And Is Subject To Change

Updated Material Will Be Available @ www.manasseauctions.com

Statements Made Day of Sale Take Precedence Over Printed Material.

PLEASE NOTE:

Brochure Is Continually Being Updated,

Please Keep Track Of Our Website For Updated Information www.manasseauctions.com

City Of Cortland

|

Serial #11 |

|

NO PICTURE |

|

Serial # 55 |

|

|

|

Serial # 57 |

|

|

|

Serial #154 |

|

|

|

Serial #188 |

|

|

|

Serial #234 |

|

|

|

Serial #89

|

|

NO PICTURE |

Town Of Cortlandville

|

Town Of Cortlandville

|

|

|

|

Town Of Cortlandville |

|

|

Town Of Freetown

|

Town Of Freetown |

|

|

|

Town Of Freetown |

|

|

Town Of Harford

|

Town Of Harford |

|

|

Town Of Homer

|

Town Of Homer |

|

|

|

Town Of Homer |

|

|

Town Of Marathon

|

Town Of Marathon

Address:

McGraw Marathon Road |

|

|

|

Town Of Marathon

|

|

|

|

Town of Marathon

|

|

|

|

Town of Marathon

|

|

|

Town Of Preble

|

Town Of Preble |

|

NO PICTURE |

Town Of Scott

|

Town Of Scott |

|

|

|

Town Of Scott |

|

NO PICTURE |

|

Town Of Scott |

|

NO PICTURE |

|

Town Of Scott

|

|

|

Town Of Solon

|

Town Of Solon |

|

|

Town Of Virgil

|

Town Of Virgil |

|

|

|

Town of Virgil |

|

|

Town Of Willet

|

Town Of Willet |

|

NO PICTURE |

|

Town Of Willet

|

|

|

Village Of Marathon

|

Village Of Marathon Address: Grove Street Lot Size: 50 x 84 Tax Map #: 157.20-03-35.000 School District: Marathon Assessment: $2,500 Description: 312 Vacant w/ Imprv.; With Red Barn/Garage Directions: In Marathon, Take 221 W/ West Main Street, To Grove Street. |

|

|

|

Village Of Marathon Address: 2 Grove Street Lot Size: 67.67 x 80 Tax Map #: 157.20-03-36.000 School District: Marathon Assessment: $63,300 Description: 210 1 Family Res.; Yellow 2-Story Wood Frame Single Family Home, Sits Up On Hill, Occupied. Directions: In Marathon, Take 221 W/West Main Street, To Grove Street. |

|

|

|

Village Of Marathon

|

|

|

All Properties Sold AS IS Properties Must Be Researched PRIOR To Bidding

Brochure Is To Be Used Only As A Guide, And Is Subject To Change Updated Material Will Be Available @ www.manasseauctions.com - Statements Made Day of Sale Take Precedence Over Printed Material.

Please Note: Brochure Is Continually Being Updated, Please Keep Track Of Our Website @ www.manasseauctions.com For Updated Information.

~ ~ ~ ~ ~ ~

WHAT ABOUT AN AUCTION?? FOR THE PROS & CONS --- CALL THE PROFESSIONALS!

*52 YEARS OF EXPERIENCE* *WE ARE FULL-TIME AUCTIONEERS*

LET OUR EXPERTISE HELP YOU MAKE A DECISION!

Sales Managers & Auctioneers

Whitney Point, NY

607-692-4540 / 1-800-MANASSE

WWW.MANASSEAUCTIONS.COM