TIOGA COUNTY

Real Property Tax Foreclosure

AUCTION

Properties Of All Types

Throughout Tioga County, NY

Wednesday

August 7, 2019

6:00 PM

Auction To Be Held At: Tioga County Office Building- Auditorium,

56

Main Street, Owego, NY

TERMS & CONDITIONS

GENERAL:

1.

All properties offered at this auction have been foreclosed under Article

11 of the New York State Real Property Tax Law.

2.

All properties are sold AS IS-WHERE IS. Bidder shall be

solely responsible for determining all conditions of the property prior to

bidding. The County sells only its lien or interest. All deeds issued shall be

by Quit Claim Deed only. The County makes no representation as to the

quality of title, lot size, shape or location or conditions or existence of any

or all improvements on any parcel. The County will not furnish an abstract of

title or title insurance.

3.

All references to Mobile Homes, manufactured housing, or any description

thereof are for identification purposes only. The County makes no

representation as to whether or not the mobile home, manufactured housing, shall

be considered attached to the property. All determinations as to the status of

the mobile home, manufactured housing, shall be the sole responsibility of the

purchaser and the County shall make no representations or warranties.

4.

Properties will be conveyed to the highest qualified bidder. The Tioga

County Legislature reserves the right to reject any and all bids of any kind.

Neither the delinquent taxpayer nor anyone acting on their behalf shall be

entitled to bid or purchase the property for less than the full amount due

including all taxes, fees and penalties once the County has taken title.

Those individuals who have previously defaulted on a bid, or who are currently

delinquent on any other parcel in the County shall not be permitted to bid on

any additional County properties offered at this auction.

5.

Any promotional tools such as photographic slides, tax maps, written or

verbal descriptions, etc. are for informational purposes only. Each bidder

should research and visually locate the properties prior to bidding. Town

zoning and building code information can be obtained at the town or village

where the property is located. It is the responsibility of the bidder to

research any existing violations or restrictions on the property.

6.

Risk of loss or damage by fire, vandalism or any other cause (except

taking under the power of eminent domain) between the time of sale and the time

of deed delivery is assumed by the purchaser.

7.

All potential Bidders must show acceptable identification for issuance of

a Bidder/Buyer number.

8.

All Bidders and all Buyers must register for this auction and must hold a

Bidder/Buyer number.

9.

Each purchaser will be required to sign a legally binding Property Bid

Acknowledgement Form for each purchase which commits the purchaser to compliance

with all Terms and Conditions as stated herein.

10.

The Tioga County Treasurer reserves the right to withdraw from sale any

properties which are listed and or at his option, to group one or more parcels

together into one sale.

11.

All decisions regarding the bidding disputes shall remain completely

within the Auctioneers discretion.

12.

The Auctioneer retains the right to reject any bid that is not within

current bidding increments or that is not an appropriate advancement over the

preceding bid.

13.

The Auctioneer and the Seller shall remain forever immune from any and

all liability concerning any personal injury, environmental hazards or property

damage occurring before, during or after the auction, no matter what the cause.

Additionally, the Auctioneer and Seller shall remain forever immune from the

consequence of purchase of any and all properties at this auction.

14.

The winning bidder will be responsible for the removal of any unwanted

occupants/tenants on the property after the auction.

FINANCIAL:

15.

Payments shall be made by cash, business or personal check drawn on New

York State Or Pennsylvania Bank, bank check, certified check or money order.

Bank instruments must be made payable to the Tioga County Treasurer. The

property transfer reports will be prepared and the closing process conducted by

the Tioga County Treasurers Office.

16.

Full payment must be made immediately at knockdown (when the Auctioneer

says sold), for any and all properties sold for $3,000 or less.

17.

For any and all properties sold for more than $3,000, the amount of

$3,000 plus 10% of the amount over $3,000 must be paid immediately at

knockdown.

18.

The Successful Bidder must also pay a Buyers Premium of 7%

of the Selling Bid Price, in a separate check or cash payable to Mel Manasse &

Son, the day of the Auction.

19.

The remainder of the purchase price must be paid with guaranteed funds

and received by the Tioga County Treasurer at a scheduled closing, in

approximately one month. All closings must be conducted by September 30th.

Tioga County Treasurers Office

56 Main Street, Room 210

Owego, New York 13827

20.

The purchaser, at closing, will pay all recording fees. Check To Be Made

Payable To Tioga County Clerk.

21.

Failure to close on a property or failure to pay the remainder of the

purchase price, subjects the purchaser to loss of any and all monies, and all

rights or claims to the property in question.

TAXES:

22.

The purchaser will be responsible for the following taxes and charges

including all interest and penalties:

-Current 2019 Village Taxes (if

property is located in a village)

- School Taxes Due by the end

September

-Current Sewer, Water, Lighting

or Special District Taxes or charges (if applicable)

-Future Town and County Tax

Bills (past due town & county bills have been written off)

It will be the responsibility of the purchaser

to ascertain what charges exist on a property.

Please contact the appropriate village,

school, or sewer, lighting district or town for this information.

ASSESSMENTS:

23.

The information booklet lists the 2019 assessments for each property.

Bidders or Purchasers

with questions

regarding assessed values or assessment practices are advised to contact the

Assessors Office of

the town in which the property is located.

~ ~

~ ~

All Properties Sold AS IS Properties Must Be

Researched PRIOR To Bidding

Brochure Is To Be Used Only As A Guide, And Is

Subject To Change

Updated Material

Will Be Available @

www.manasseauctions.com

Statements

Made Day of Sale Take Precedence Over Printed Material.

PLEASE NOTE:

Brochure Is

Continually Being Updated, Please Keep Track Of Our Website @

www.manasseauctions.com

For Updated Information.

2 NEW SHOWINGS ADDED For Monday, August 5th.

Open House Schedule

Sunday, August 4, 2019

9:30AM-10:30AM

Sale #: 1 Town of

Barton 5 Ithaca Street

Sale #: 2 Town of

Barton 30 Pembleton Place

11:00AM-12Noon

Sale #: 17 Town of Nichols

147 Pamela Drive

1:00PM-2:00PM

Sale #: 7 Town of

Candor 25 Smith Street

Sale #: 49 Town of

Tioga 169 Winters Road

3:00PM-4:30PM

Sale #: 25 Town of

Owego 9528 Rt. 17C

Sale #: 26 Town of

Owego 6 Exeter Drive

5:15PM-6:30PM

Sale #: 37 Town of

Richford 2 Aurora Street

Sale #: 5 Town of

Berkshire 3678 Wilson Creek Rd

Sale #: 12 Town of

NV 591 NV-Maine Rd

Monday,

August 5, 2019 - 2 New Showings Added

5:00PM-6:00PM

Sale #: 22 Town of

Owego 106 Chestnut Street

Sale #: 23 Town of

Owego 112 Liberty Street

5:30PM-6:30PM

Sale #: 18 Town of Nichols 33 Mount Pleasant Rd.

*Just Added*

5:30PM-7:00PM

Sale #: 29 Town of Owego 174 Brainard

Street *Just Added*

2

NEW SHOWINGS ADDED For Monday, August 5th.

Click Here To Visit Online Tax Map's

Removed From Auction:

#36 61 Liberty Street Owego

Town of

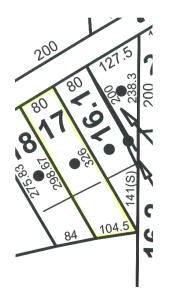

Barton

|

Town Of

Barton-Vlg. of Waverly

Address:

5 Ithaca Street

Lot Size:

45FF x 124

Tax Map

#:

166.16-3-3

Assessment: $61,500

Description: 210 1 Family Res., Blue Wooden Cedar Shake Sided,

Sgl. Family Home, 45x124 Lot, Vacant.

School: Waverly

Directions:

Chemung Street or Cayuta Ave to Ithaca Street.

Open

House:

Sun. Aug 4 @

9:30AM-10:30AM |

|

1 |

|

Town Of

Barton-Vlg. of Waverly

Address:

30 Pembleton Place

Lot Size: 50FF

x 125

Tax Map

#: 167.09-1-12.20

Assessment: $14,400

Description: 270 Mfg Housing, Gray Sgl. Wide Mobile Home on

Lot, Village Water. Vacant.

School: Waverly

Directions:

Rt. 17C Just East of Waverly to Pembleton Place on Left, Go 2/10 To

Place on Right.

Open

House:

Sun. Aug 4 @

9:30AM-10:30AM |

|

2 |

|

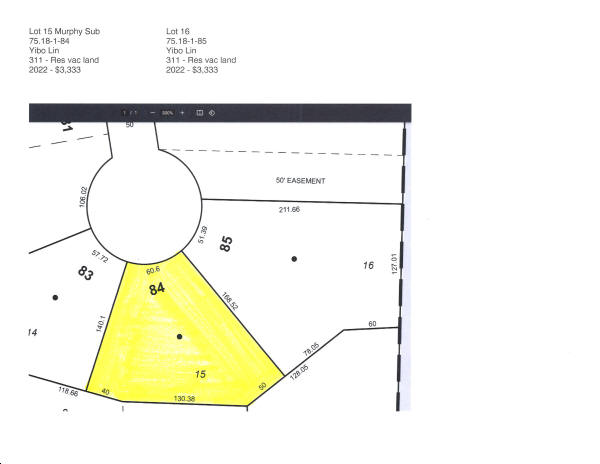

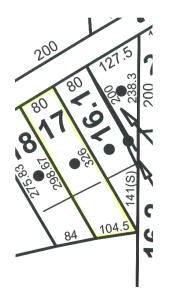

Town Of

Barton

Address: Acme

Road

Lot Size:

86 Acres; 1,940FF

Tax Map

#: 123.00-3-1

Assessment: $73,800

Description: 322 Rural Vac. > 10, 86 Acres Wooded Vacant Lot,

Lots of Road Frontage. Property Starts Across From Entrance of Williams

Rd. & Goes North. Nice Parcel.

School: Waverly

Directions:

Rt. 17C to Talmadge Hill Road Go Straight on Ridge Rd. to Right on

Coleman Rd., Go ½ Mile to Left on Acme Rd. Go To Prop. On Right.

|

|

3 |

|

Town Of

Barton

Address: 84

Williams Road

Lot Size:

5 Acres; 250FF

Tax Map

#: 123.00-2-18.20

Assessment: $79,000

Description: 416 Mfg. Housing Pk. Multiple Trailer Park on 5

Acre Lot, Has 3 Homes Currently, Tan SW Mobile Home in Front. Light Blue

SW Mobile Home in Middle. White SW Mobile Home in Rear Appears to Have

1-2 Other Mobile Home Hookups/Spots. All Homes Are Occupied.

School: Waverly

Directions:

Rt. 17C to Talmadge Hill Road Go Straight on Ridge Rd. to Right on

Coleman Rd., Go ½ Mile to Left on Acme Rd go 2 Miles to Left on Williams

Road. |

|

4 |

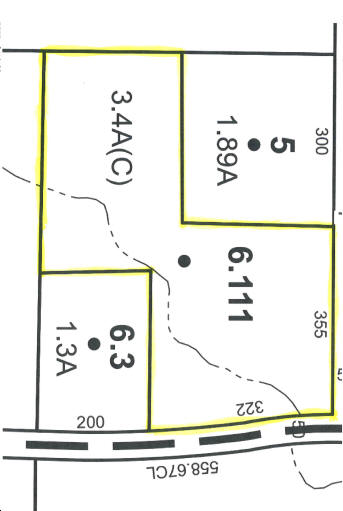

Town of

Berkshire

|

Town Of

Berkshire

Address: 3678

Wilson Creek Road

Lot Size: 171FF

x 171

Tax Map

#: 32.00-1-20

Assessment: $24,800

Description: 210 1 Family Res., Cedar Sided 2-Sty Sgl. Family

Home, Vacant.

School: Newark Valley

Directions:

From Rt. 38 by NV High School, Take Wilson Creek Rd. 4 Miles to Home on

Right.

Open

House:

Sun. Aug 4 @

5:15PM-6:30PM |

|

5 |

Town of

Candor

|

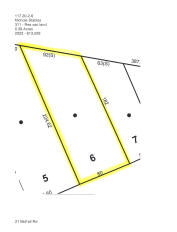

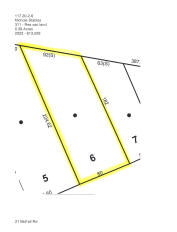

Town Of

Candor

Address: 22

Delray Ave

Serial Number:

Lot Size: 0.22

Acres; 66FF

Tax Map

#: 61.13-1-26

Assessment: $60,800

Description: 210 1 Family Res., White Stucco 2-Sty Sgl. Family

Home w/ 1-Car Garage and Barn in Rear, Occupied.

School: Candor

Directions:

Rt. 96 or Main St. to Delray Ave in Village of Candor. |

|

6 |

|

Town Of Candor-Vlg. of Candor

Address:

25 Smith Street

Lot Size: 144FF

x 64

Tax Map

#: 61.09-2-7

Assessment: $21,900

Description: 270 Mfg Housing, White/Brown Sided SW. Mobile Home

on Lot

School: Candor

Directions:

Main St. to Rich St. to Right on Smith St. or Main St.(Rt. 96) to Smith

St.

Open

House:

Sun. Aug 4 @

1:00PM-2:00PM |

|

7 |

|

Town Of Candor

Address:

26 Bush Road

Lot Size: 208FF

x 183

Tax Map

#: 27.00-1-9.412

Assessment: $7,000

Description: 270 Mfg Housing, Older Camping Trailer on 208x183

Lot, Mostly Wooded Land, May Have Utilities?

School: Candor

Directions: From Candor Take Rt. 96B 3 Miles to Prospect Valley

Rd. 2.9 Miles to Left on Bush Rd. Go 1/10 Mile to Place.

|

|

8 |

|

Town Of

Candor

Address:

673 Back West Creek Rd

Lot Size: 9.17

Acres, 151FF; 522FF; Property On Both Sides of Road.

Tax Map

#: 52.00-2-2.12

Assessment: $95,900

Description: 280 Res. Multiple, White 2-Sty Sgl./Multi Family

Home Up On Hill on 9.17 Acre Lot, Has 2-Car Garage Down Closer to Road.

Occupied.

School: Newark Valley

Directions: From Weltonville Take West Creek 1.5 Miles to Back

West Creek Rd. 3.1 Miles to DW on Left Up On Hill.

|

|

9 |

|

Town Of Candor

Address:

406 Prospect Valley Rd

Lot Size: 215FF

x 185

Tax Map

#: 38.00-1-23

Assessment: $22,000

Description: 312 Vac. w/ Imprv., Partial Structure/Cabin, Needs

Repairs/Finishing. 215FFx85 Lot.

School: Candor

Directions: Take Rt. 96B West 3 Miles to Right on Prospect Valley

Rd. Go 1.9 Miles to Place on Left. |

|

10 |

|

Town Of Candor

Address:

Newman Road

Lot Size: 17.67

Acres; 175FF

Tax Map

#: 51.00-1-13.10

Assessment: $18,100

Description: 322 Rural Vac. < 10, Mostly Wooded in Front, Open

in Rear.

School: Newark Valley

Directions: From Candor Take Honeypot Rd. 8/10 Mile to Candor

Hill Rd. Go 3 Miles to Right on Fairfield Rd. Go 1 Mile to Left on

Newman Rd. Go 8/10 Mile to Place on Right Just After House #149, Before

House #164. |

|

11 |

Town of

Newark Valley

|

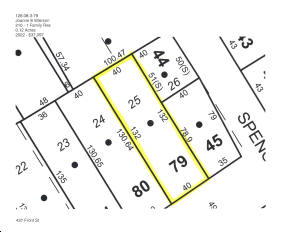

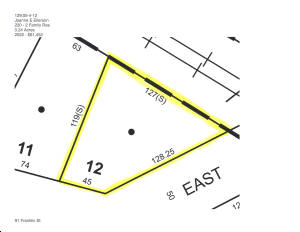

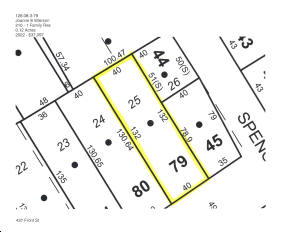

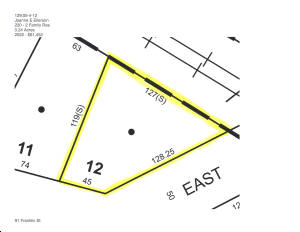

Town Of Newark Valley

Address:

591 Newark Valley Maine Road

Lot Size: 99FF

x 201.87

Tax Map

#: 64.00-2-23

Assessment: $62,000

Description: 210 1 Family Res., White Sided Sgl. Sty Ranch,

Sgl. Family Home w/ Car Port. Vacant

School: Newark Valley

Directions: In NV Take Rock St. East (By Conv. Store) NV Maine

Rd. Go 6/10 Mile to Place On Left.

Open

House:

Sun. Aug 4 @

5:15PM-6:30PM |

|

12 |

|

Town Of Newark Valley

Address:

234 S Ketchumville Road

Lot Size: 1

Acre

Tax Map

#: 44.00-1-45

Assessment: $35,000

Description: 210 1 Family Res., White Sgl. Sty Ranch Home, On

ROW, #232 DW, Vacant on 1 Acre Lot.

School: Newark Valley

Directions: From Ketchumville Take S. Ketchumville Rd. South 4/10

Mile to Place on Right. |

|

13 |

|

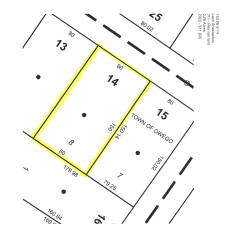

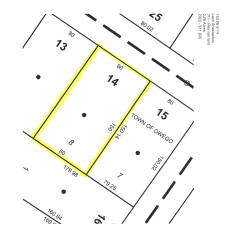

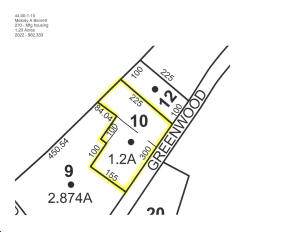

Town Of

Newark Valley

Address:

5 Spring Street

Lot Size: 75FF

x 75

Tax Map

#: 64.19-1-4

Assessment: $20,000

Description: 270 Mfg Housing, Tan SW Mobile Home w/ Addition on

Lot. Vacant, Has Utilities.

School: Newark Valley

Directions: In NV Take Water St. to Left on Maple St. to Left on

Marble St. to Right on Spring St. |

|

14 |

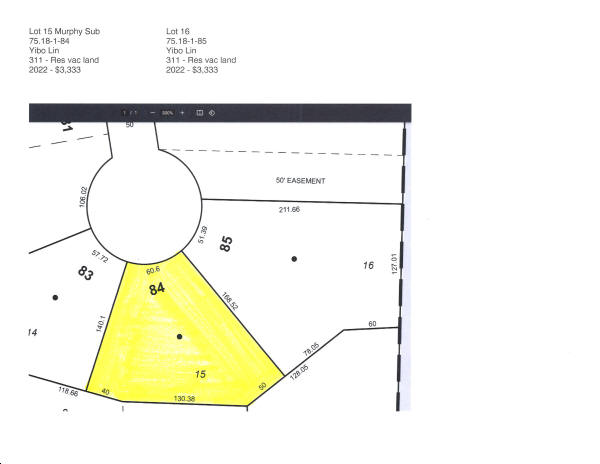

|

Town Of

Newark Valley

Address:

West Creek Road

Lot Size: 0.67

Acres; 75FF

Tax Map

#: 52.00-1-12.42

Assessment: $500

Description: 314 Rural Vac < 10, Vacant Lot.

School: Newark Valley

Directions: From Rt. 38 Take West Creek Rd. 5.6 Miles to Lot on

Right Just Before Blue Mobile Home. |

|

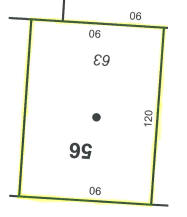

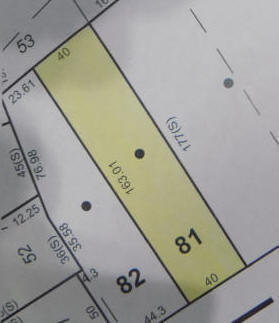

16 |

Town of

Nichols

|

Town Of

Nichols

Address:

147 Pamela Drive

Lot Size: 100

x 195

Tax Map

#: 149.13-1-27

Assessment: $23,400

Description: 210 1 Family Res., Light Green Sided Ranch Sgl.

Family Home w/ 1-Car Attached Garage.

School: Owego-Apalachin

Directions: From Nichols Take River St. (CR502) Go 3 Miles to

Taylor Ave to Right on Pamela Dr. Go To End of Street on Right.

Open

House:

Sun. Aug. 4th 11:00AM-12Noon |

|

17 |

|

Town Of

Nichols

Address:

33 Mount Pleasant Road

Lot Size: 1.56

Acres; 233FF, 304FF Corner Lot.

Tax Map

#: 168.00-3-11.70

Assessment: $26,500

Description: 210 1 Family Res., White DW Mobile Home w/ 2-Car

Detached Garage on Nice Corner Lot, Vacant.

School: Tioga

Directions: From Nichols Take West River Rd. 5 Miles Almost To PA

Line To Left on Mount Pleasant Rd. Home is on Corner.

Open

House:

Mon. Aug 5 @ 5:30-6:30 Just Added ** |

|

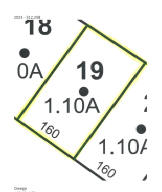

18

|

|

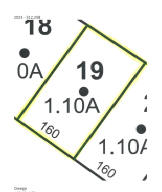

Town Of

Nichols

Address:

913 Sibley Road

Lot Size: 2.7

Acres; 364 FF

Tax Map

#: 172.00-1-9.10

Assessment: $25,000

Description: 210 1 Family Res., White Sided Sgl. Sty Ranch

Home. Single Family. Vacant.

School: Owego-Apalachin

Directions: From Owego(South Side) Take Sulphur Springs Rd. To

Right on Sibley Rd. Go 8/10 Miles to Home on Right. |

|

19 |

|

Town Of

Nichols

Address:

632 South Main Street

Lot Size: 1

Acre; 271FF

Tax Map

#: 170.00-2-2

Assessment: $20,000

Description: 210 1 Family Res., White Sided 2-Sty Sgl. Family

Home w/ 2-Car Detached Barn/Garage, Occupied.

School: Tioga

Directions: From Nichols Take S. Main St.(Rt. 282) South ½ Mile

to Place on Left. |

|

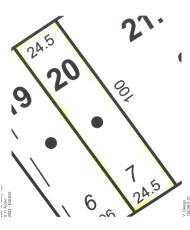

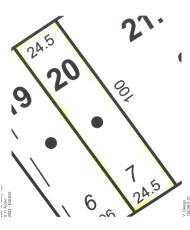

20 |

|

Town Of

Nichols

Address:

2953 River Road East

Lot Size:

1.5 Acres; 260FF & 240FF

Tax Map

#: 149.00-1-33

Assessment: $5,000

Description:

311 - Res Vac. Land, Vacant Lot w/ Utilities.

Property on Both Sides of Road.

School: Owego-Apalachin

Directions: From Nichols Take East River Rd. 4 Miles to Lot on

Left. |

|

NO PIC

21 |

Town of

Owego

|

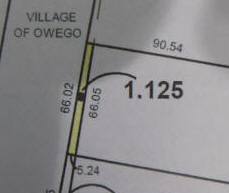

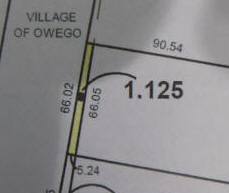

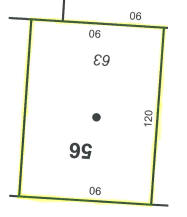

Village

of Owego

Address:

106 Chestnut Street

Lot Size: 0.1

Acres; 40FF x 100'

Tax Map

#: 128.08-3-71

Assessment: $46,000

Description: 210 1 Family Res., Red Sided 2-Sty Sgl. Family

Home on Higher Lot. Vacant

School: Owego-Apalachin

Directions: Rt. 38 to North Ave to Chestnut St.

Open

House:

Mon. Aug 5 @

5:00PM-6:00PM |

|

22 |

|

Town Of

Owego

Address:

112 Liberty Street

Lot Size: 0.15

Acres; 40FF

Tax Map

#: 128.08-7-81

Assessment: $53,500

Description: 210 1 Family Res., Light Blue Sided 2-Sty Sgl.

Family Home on Nice Lot. Vacant

School: Owego Apalachin

Directions: North Ave to Fox St. to Liberty St.

Open

House:

Mon. Aug 5 @

5:00PM-6:00PM |

|

23 |

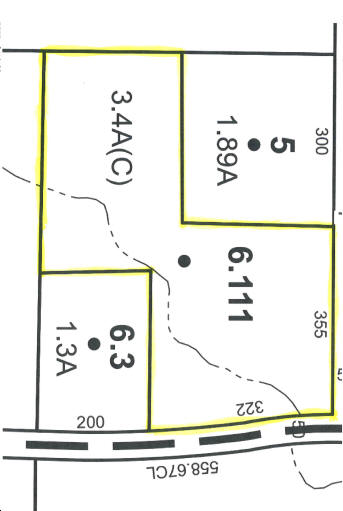

|

Town Of

Owego

Address:

9528 State Route 17C

Lot Size: 0.26

Acres; 100FF

Tax Map

#: 143.10-1-38

Assessment: $52,400

Description: 210 1 Family Res., White Cedar Sided 2-Sty Sgl.

Family Home w/ Small Addition. Vacant.

School: Union Endicott

Directions: Rt. 17C East of Apalachin. Bridge 2 Miles Almost to

Tioga/Broome Co. Line.

Open

House:

Sun. Aug 4 @

3:00PM-4:30PM |

|

25 |

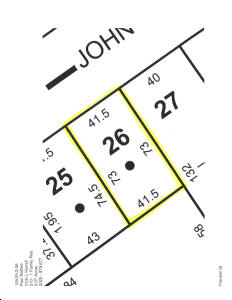

|

Town Of

Owego

Address:

6 Exeter Drive

Lot Size: 0.23

Acres

Tax Map

#: 143.09-1-37

Assessment: $82,600

Description: 210 1 Family Res., White Sided/Brick Sided Ranch

Home w/ 1-Car Garage. Needs Work. Vacant

School: Union Endicott

Directions: Rt. 17C to Holiday Hill Rd. (Toward School) to Left

on Dover Dr. to Right on Exeter Dr.

Open

House:

Sun. Aug 4 @

3:00PM-4:30PM |

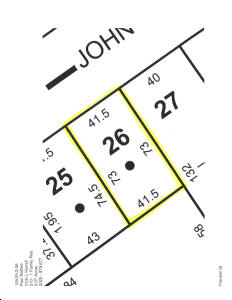

|

26 |

|

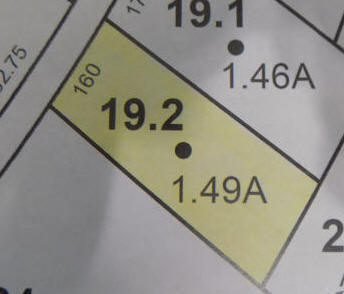

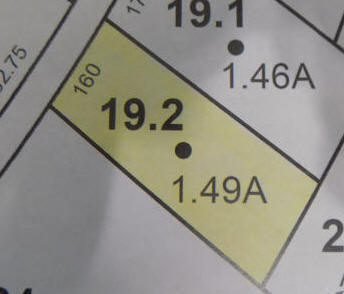

Town Of

Owego

Address:

2697 Bolles Hill Road

Lot Size: 1.49

Acres; 160FF

Tax Map

#: 175.00-2-19.2

Assessment: $49,100

Description: 210 1 Family Res., Vacant Lot w/ Burned Remains of

Home on 1.49 Acre Lot.

School: Owego-Apalachin

Directions: Pennsylvania Ave South of Apalachin 5.8 Miles Just

Into PA to Left on Bolles Hill Rd. Go ½ Mile, Bare to Left Place on

Right. |

|

27 |

|

Town Of

Owego

Address:

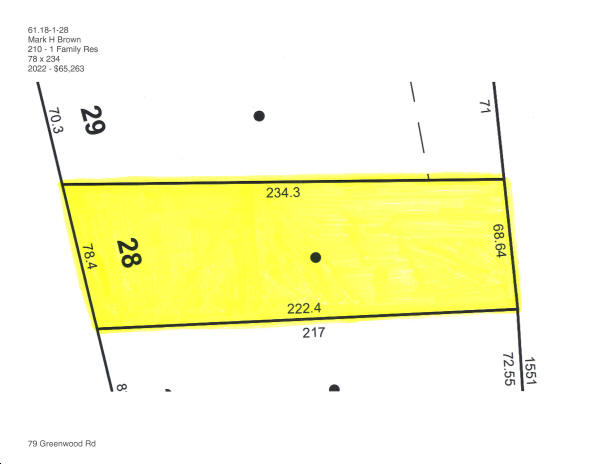

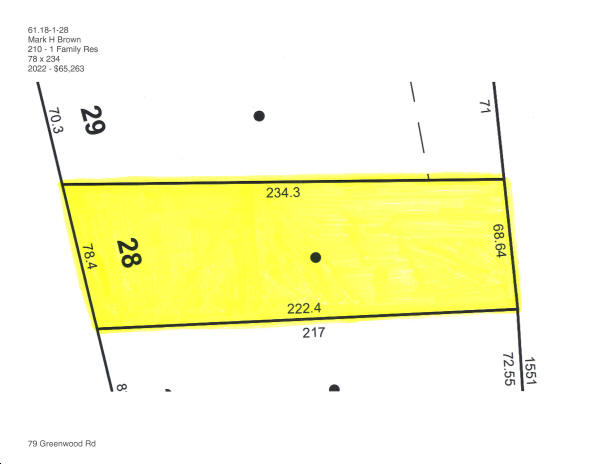

2067 Gaskill Road

Lot Size:

0.41 Acres; 147FF

Tax Map

#: 96.00-2-22

Assessment: $68,600

Description: 210 1 Family Res., White Sided Ranch, Sgl Sty

Family Home w/ 2-Car Attached Garage, Occupied.

School: Newark Valley

Directions: From Day Hollow Rd. Take Gaskill Rd. 3.7 Miles To

House on Right. Corner of Lisle Rd. & Gaskill Rd. |

|

28 |

|

Town Of

Owego

Address:

174 Brainard Street

Lot Size:

0.48 Acres

Tax Map

#: 131.19-1-32.2

Assessment: $113,700

Description: 210 1 Family Res., Yellow Sided/Brick Split Level

Home w/ 2-Car Garage 2-Sty Sgl Family Home. Beautiful Home! Vacant.

School: Owego-Apalachin

Directions: In Campville Take Brainard Street Across Bend To

Left, Home on Right.

Open

House:

Mon. Aug 5 @ 5:30-7:00PM Just Added ** |

|

29 |

|

Town Of

Owego

Address:

W/O McMaster Street

Lot Size:

0.01 Acres

Tax Map

#: 128.08-1-1.123

Assessment: $50

Description: 311 Res. Vac. Land, Behind 63 McMaster St. Vacant

Lot w/ FF. Tree in Front on Road Frontage.

School: Owego-Apalachin

Directions: Rt. 96 to Fox St. to McMaster St. |

|

NO PIC

30 |

|

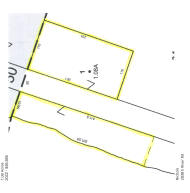

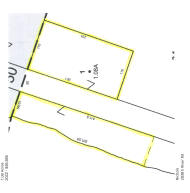

Town Of

Owego

Address:

N/S New Street

Lot Size:

0.36 Acres; 42FF

Tax Map

#: 142.14-1-27.21

Assessment: $6,000

Description: 311 Res. Vac. Land, Vacant Open Lot on Southside

of Blue DW Home #6.

School: Owego-Apalachin

Directions: Take Pennsylvania Ave to W. Main Street to New

Street. Lot on Right. |

|

31 |

|

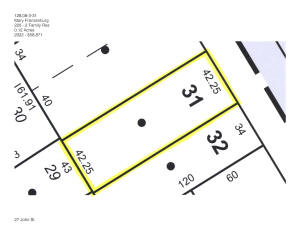

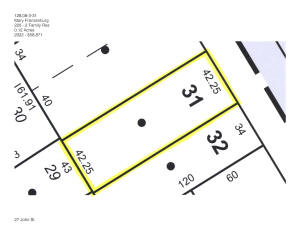

Town Of

Owego

Address:

E/S Stakmore Lane

Lot Size:

0.01 Acres

Tax Map

#: 128.08-1-1.125

Assessment: $10

Description: 311 Res. Vac. Land, Vacant Lot NO FF

School: Owego-Apalachin

Directions: Rt. 17C to Stakmore Lane. |

|

NO PIC

32 |

|

Town Of

Owego

Address:

State Route 17C S/S

Lot Size: 1.42

Acres

Tax Map

#: 142.15-1-31

Assessment: $6,100

Description: 311 Res. Vac. Land, Vacant Wooded Lot.

School: Owego-Apalachin

Directions: From Light at New Bridge Take 17C West 2/10 Mile to

Lot on Right Across From House #7373 |

|

34 |

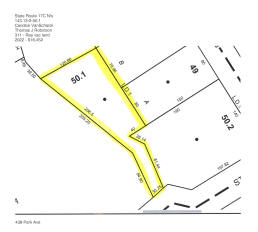

|

Town Of

Owego

Address:

4809 Pennsylvania Ave

Lot Size:

0.39 Acres; 187FF

Tax Map

#: 175.00-2-48

Assessment: $20,000

Description: 312 Vac. w/ Imprv., .39 Acre Lot w/ White Sided

2-Car Garage/Shop. Lot Has Utilities?

School: Owego-Apalachin

Directions: From Apalachin Take Pennsylvania Ave South 4.5 Miles

to Place on Left. 2 ¾ Mile North of NY/PA Line. |

|

35 |

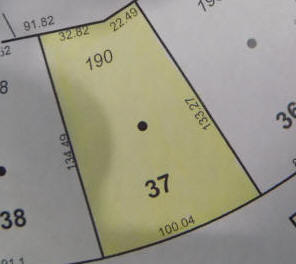

Town of

Richford

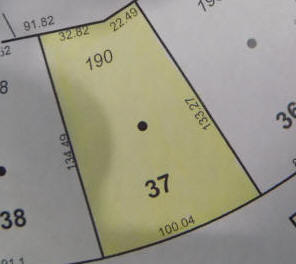

|

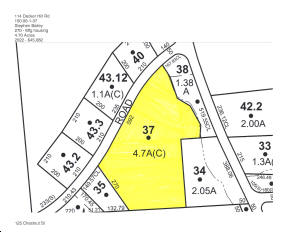

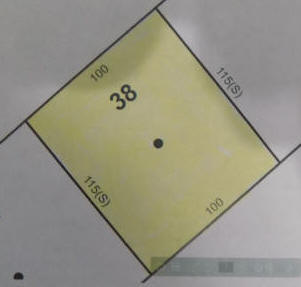

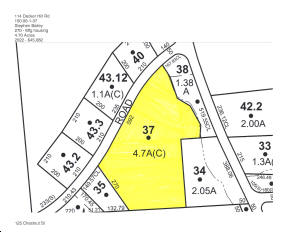

Town Of

Richford

Address:

80 Chwalek Road

Lot Size:

2.78 Acres

Tax Map

#: 4.00-1-4.20

Assessment: $85,700

Description: 210 1 Family Res., Gray Vinyl Sided DW Mobile Home

on Wooded Lot, Shared Driveway. On 2.78 Acres. Occupied.

School: Newark Valley

Directions: From Rt. 79 East of Richford Take Victory Hill Rd. 2

Miles Left on Michigan Hill Rd. Go 1.2 Miles to Right on Rockefeller Rd.

Go 1 Mile to Left on Chwalek Rd. Go 3/10 Miles to Place on Right. Go

Down Driveway Bare to Left. |

|

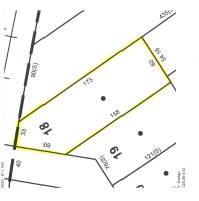

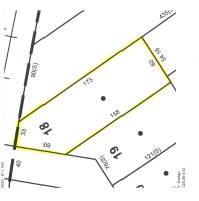

37 |

|

Town Of

Richford

Address:

2 Aurora Street

Lot Size:

106FF x 118FF

Tax Map

#: 11.18-1-37

Assessment: $57,500

Description: 210 1 Family Res., Tan Sided w/ Red Shutters, DW

Mobile Home on Village Lot. Vacant

School: Newark Valley

Directions: In Richford, Front of Aurora St. & Rt. 38.

Open House:

Sun. Aug 4 @

5:15PM-6:30PM |

|

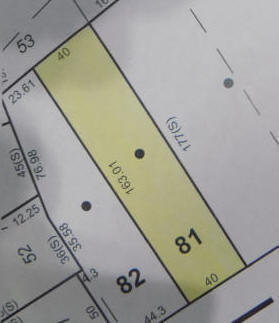

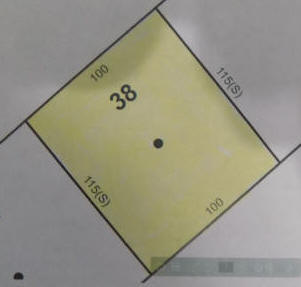

38 |

|

Town Of

Richford

Address:

Off Andersen Hill Road

Lot Size:

175 x 200

Tax Map

#: 14.00-1-6.50

Assessment: $8,800

Description: 312 Vac. w/ Imprv., Has Utilities.

School: Newark Valley

Directions: Anderson Hill From Richford To Jacob Dr. Just Before

Brumnage Rd. On Right Go Out Jacob 400Ft. Lot is on Left Just Past 11

Jacob Dr. |

|

39 |

|

Town Of

Richford

Address:

Matson Road

Lot Size:

21.56 Acres; 655FF

Tax Map

#: 2.00-2-34

Assessment: $40,200

Description: 322 Rural Vac. > 10, 21.56 Acres, Vacant Wooded

Land & Has FF.

School: Marathon

Directions: Rt. 79 West of Richford to West Hill Rd. Go 1.7 Miles

Straight on Matson Rd. 9/10 Miles to Property on Right. Prop. 800Ft Past

House #539 on Right Side of Rd. |

|

NO PIC

40 |

|

Town Of

Richford

Address:

Rockefeller Road

Lot Size:

10 Acres

Tax Map

#: 4.00-1-10.30

Assessment: $25,000

Description: 322 Rural Vac. > 10, Wooded Vacant Lot on 10

Acres, Nice Land!

School: Newark Valley

Directions: From Rt. 79 East of Richford Take Victory Hill Rd. 2

Miles to Left on Michigan Hill Rd. Go 1.2 Miles to Right on Rockefeller

Rd. Go 1.5 Miles to Lot on Left Just Past House #309 Just Before House

#333. |

|

NO PIC

41 |

Town of

Spencer

|

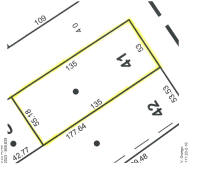

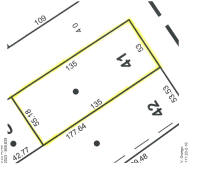

Town Of

Spencer

Address:

95 Dodge Road

Lot Size:

5 Acres; 233FF

Tax Map

#: 79.00-1-37.2

Assessment: $85,000

Description: 280 Res. Multiple,Lg. Older White 2-Sty Home Plus Lg.

2-Sty Garage/Apt Bldg. Blue Cedar & Stone Sided, All on 5 Acre Lot

Frontage On Both Finkenbinder Rd. and Dodge Rd. Occupied.

School: Spencer Van-Etten

Directions: South Main St. to Left on South Hill Rd. Go 1 Mile to

Right on Dodge Rd. Go 4/10 Mile to Left on Dodge Rd. Go 4/10 Mile to

Place on Right. |

|

42 |

Town of

Tioga

|

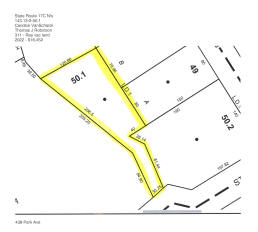

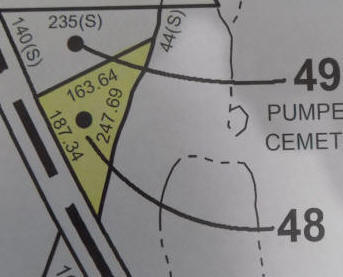

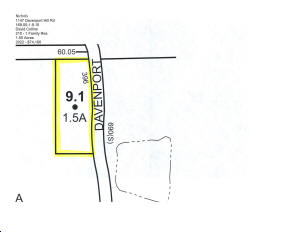

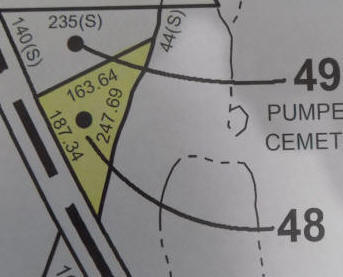

Town Of

Tioga

Address:

713 Glenmary Drive

Lot

Size:

1.16 Acres

Tax Map #: 117.11-2-7

Assessment: $4,000

Description: 210 1 Family Res., Light Blue 2-Sty House w/ Barn

in Back.

School: Owego-Apalachin

|

|

43 |

|

Town Of

Tioga

Address:

338 Bentbrook Road

Lot Size:

6 Acres

Tax Map #: 148.00-1-9.20

Assessment: $8,100

Description: 210 1 Family Res., Brown Sided 2-Sty. Contemporary

Home Down Long Driveway w/ Lg. Deck, Occupied.

School: Tioga

Directions: Halsey Valley Road to Allyn Road, Go 1.7 Mile to

Bentbrook Road, Go 4/10 Mile to Long Driveway on Right.

|

|

NO PIC

44 |

|

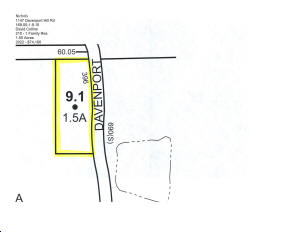

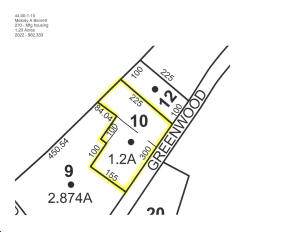

Town Of

Tioga

Address:

1174 Straits Corners Rd

Lot Size:

3 Acres; 315FF

Tax Map #: 104.00-1-16.20

Assessment: $900

Description: 270 Mfg Housing, Old Sgl. Wide Mobile Home Down

Long Driveway on 3 Acre Lot. Poor Condition, Vacant.

School: Tioga

Directions: From Halsey Valley Road Take Straits Corners Rd. 3.1

Miles to Driveway on Left. |

|

45 |

|

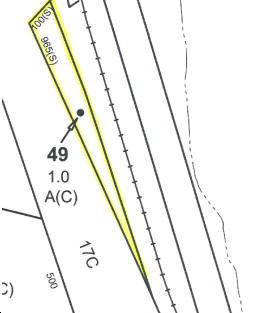

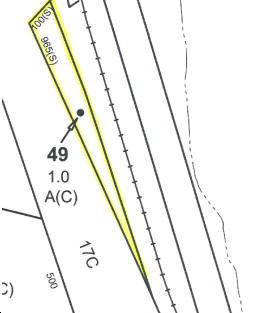

Town Of

Tioga

Address:

171 Winters Road

Lot Size:

2.17 Acres; 167FF

Tax Map #: 147.00-2-3.25

Assessment: $3,600

Description: 271 Mfg Housings, Light Blue Sgl. Wide Mobile Home

on 2.17 Acre Lot, Appears to Have Utility For More Trailers, Good FF,

Vacant

School: Tioga

Directions: Halsey Valley Road to Allyn Road, Go 1.7 Mile to

Bentbrook Road, Go 7/10 Mile to Left on Winters Road Go ¾ Mile to Place

on Right.

|

|

46 |

|

Town Of

Tioga

Address:

169 Winters Road

Lot Size:

2.35 Acres; 167FF

Tax Map #: 147.00-2-3.24

Assessment: $3,600

Description: 271 Mfg Housings, (2) Sgl. Wide Mobile Homes on

2.35 Acre Lot w/ Utilities. Good FF, White Sided Home in Front, Brown

Sided SW Mobile Home in Rear. Vacant, Show.

School: Tioga

Directions: Halsey Valley Road to Allyn Road, Go 1.7 Mile to

Bentbrook Road, Go 7/10 Mile to Left on Winters Road Go ¾ Mile to Place

on Right.

Open

House:

Sun. Aug 4 @

1:00PM-2:00PM |

|

47 |

Auctioneers & Licensed Real Estate Brokers

Licensed Real

Estate Brokers In NY & PA

Whitney Point, N.Y.

13862

607-692-4540 /

1-800-MANASSE

www.manasseauctions.com